Tax settings in your Square POS should only be used to apply the relevant sales tax for your region.

⚠️ Using taxes in Square for anything that is not a tax will result in errors ⚠️

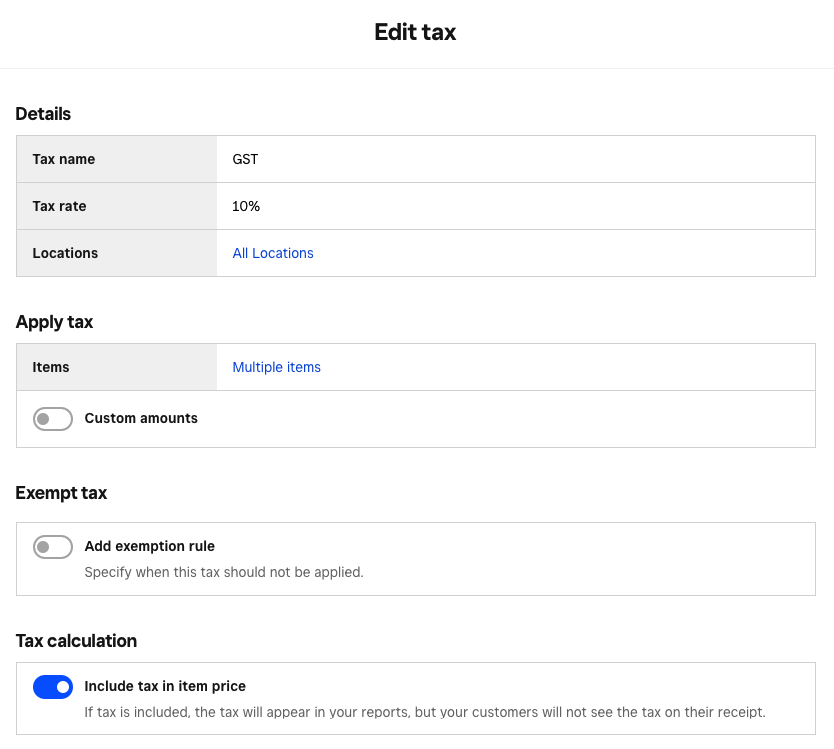

The only tax you should have configured in your POS is the local sales tax for your region. If your business is in Australia, you should only have a tax of 10% for GST, set to be included in item prices.

How to apply surcharges

As above, using a tax for a surcharge in Square is improper use of that setting and will result in various issues in your integration and customer experience.

To apply a surcharge on orders entered in your point-of-sale

You need to make use of the NEW service charge functionality in Square, which will allow you to apply various service charge amounts on orders you enter in your Square POS. These service charges to not affect online orders created in your Bopple-powered store or app.

See Square Help Centre: Get Started with Service Charges and Get Started with Card Surcharges Beta

To apply a surcharge on Bopple online orders

In your Bopple account you have the ability to create various fees to apply to online orders including a service charge for weekends and public holidays.

For more info see Adding Fees and Surcharges to Online Orders.

Correct tax setup

To ensure that customers are charged the correct amount and avoid any issues with tax display or order errors, you must only apply valid, legitimate taxes.

In Australia:

- One single tax on your Square account (10% GST if you're in Australia)

- Tax that is set to be included in item price

Issues

Tax displayed to customers will be higher than the legal amount

Customers will see the total of all your Square taxes applied to their online orders as one single line item for tax. If someone notices you are charging more than the legal tax amount, they may make a complaint either directly to you or to a governing body like the ACCC.

Example:

You have two taxes in Square.

- GST tax, 10% included in item prices

- Weekend Surcharge tax, 15% added to item prices

If the customer's order total is $20.00, they will see "Tax" of $5.00 (25%) when they checkout online, where as the legal amount would be $2.00 (10%)

Tax will not be applied correctly to online orders

If you are using a tax in Square for a "Weekend Surcharge", chances are you have this set to be added on top of item prices, while your "GST" will be set as included in item prices. As your Bopple account only supports one single tax rate, the way it is applied will vary depending on which of your Square taxes was synced last and the setting of that tax.

Example:

You have two taxes in Square.

- GST tax, 10% included in item prices

- Weekend Surcharge tax, 15% added to item prices

If the Square API sends the weekend surcharge tax to Bopple last, your single tax rate in Bopple will be set to 25% and will be added to item prices. This means that if a customer orders a $40.00 worth of goods, they will be charged $50.00. This is an added cost of $10.00 which is displayed as tax.

Square errors due to miscalculated tax

If you are adding and removing an additional tax for the purposes of applying an additional surcharge to orders in your POS, this can also result issues with pricing in your online store that cause Square to throw errors when new online orders are submitted to your POS. In these cases, the order will not appear in your POS and will need to be managed in your Bopple Orders Manager.

Required tax setup

To ensure that customers are charged the correct amount, and avoid any issues with tax display or order errors, your tax setup in Square must be as follows:

- One single tax on your Square account (10% GST if you're in Australia)

- Tax that is set to be included in item price